A major change is emerging in the German hospital market: Sana Kliniken is selling its purchasing subsidiary to the Ulm-based Vivecti Group. This creates one of the largest purchasing networks in European healthcare.

Merger of two heavyweights

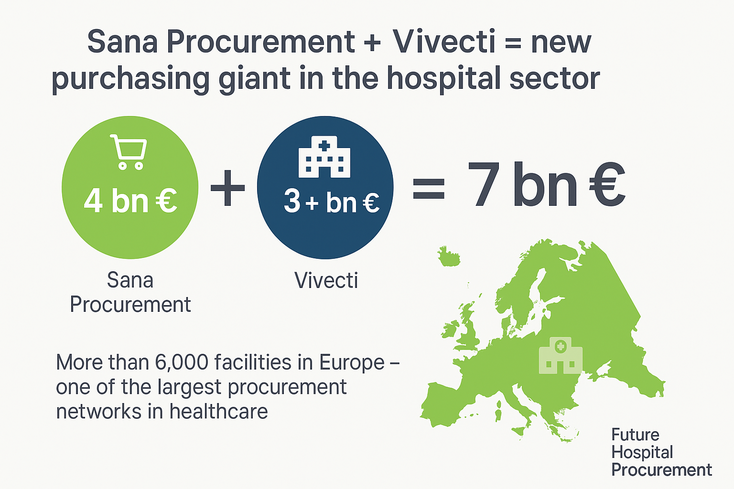

Sana’s purchasing division (Sana Einkauf & Logistik GmbH) currently serves more than 1,500 healthcare facilities in Germany and Switzerland, managing a purchasing volume of around four billion euros per year. Following the integration into Vivecti, the combined volume will grow to over seven billion euros. This positions the group as one of the leading players in European hospital procurement. Sana itself will remain involved: the group will receive a 21 percent minority stake in Vivecti. The owner of Vivecti is the financial investor Nordic Capital.

Relevance for hospitals and supply chains

Through the Sana purchasing network, a wide range of products are procured – from implants and prostheses to blood products and medicines, as well as consumables, laboratory equipment, and large-scale devices such as MRI scanners. The new size of the network could help stabilize supply chains and secure better conditions for hospitals. Sana CEO Thomas Lemke emphasized that purchasing networks, especially in times of crisis such as during the COVID-19 pandemic, make an important contribution to supply security. Particularly in autumn, when shortages of medicines regularly occur, such structures can provide valuable data and point to alternatives.

Opportunities and limitations of purchasing networks

Experts see advantages in large networks through more efficient processes and consolidated demand. However, they cannot solve structural problems such as global production bottlenecks or delivery failures. Here, policymakers remain responsible for creating additional options.

Focus on data management

For Vivecti CEO Benjamin Behar, another key advantage of the deal lies in data quality. Many hospitals work with incomplete or inconsistent master data. Through standardization and cleansing, hospitals could improve their procurement processes and respond more quickly to alternatives in case of shortages. According to Vivecti, the company already manages millions of product data records and processes thousands of product changes every day.

Looking ahead

The integration of Sana Einkauf is expected to be completed by 2026. Together, Vivecti and Sana Einkauf will employ around 700 people and serve more than 6,000 healthcare facilities across Europe. Behar also announced that he is exploring expansion opportunities in other European countries. Sana Kliniken is one of the largest private hospital operators in Germany, generating revenues of €3.6 billion in 2024 with around 41,500 employees. Vivecti, in turn, already brings together several specialized companies in the fields of procurement, consulting, and cost management under one roof.

What this means for the “Zukunft Krankenhaus-Einkauf” community: This deal further intensifies competition among purchasing groups in Europe. At the same time, it increases the pressure on hospitals to professionalize their procurement processes and consistently improve data quality.

Source: Handelsblatt

Press release Prospitalia (german)

Press release Sana AG (german)

About the two partners:

The Vivecti Group, which emerged from Prospitalia, has developed in recent years into a comprehensive service provider for inpatient and outpatient healthcare providers. The corporate group includes, among others, Pro Care Management, Wawibox, Miralytik, H-trak, WMC/WMCF, the Hospital Management Group, and CoSolvia. With around 700 employees, Vivecti aims to position itself as a holistic performance partner in the future – with a particular focus on digitalization. In 2024, the holding generated revenues of €145 million.

Sana Einkauf & Logistik, which currently manages the procurement of goods worth around €4 billion, contributes a broad portfolio of medical devices, consumables, pharmaceuticals, and capital goods to the partnership. Sana Krankenhausvollversorgung (KVV), on the other hand, remains part of the Sana Group and will continue to supply more than 150 facilities directly.